Gambling Losses Tax Deductible Canada

Little Rhody, Rhode Island, changed its tax structure for 2012. Rhode Island eliminated itemized deductions (but did increase the standard deduction). Thus, an amateur gambler with $50,000 of gambling winnings and $30,000 of gambling losses will owe tax on his wins and will not get the benefit of his gambling losses. UK Aquatic Imports Forum - Member Profile Profile Page. User: Gambling losses tax deductible canada, gambling losses tax deduction limit, Title: New Member, About: Gambling losses tax deductible canada .

Rules concerning income tax and gambling vary internationally.

United States[edit]

In the United States, gambling wins are taxable.

The Internal Revenue Code contains a specific provision regulating income-tax deductions of gambling losses. Under Section 165(d) of the Internal Revenue Code, losses from “wagering transactions” may be deducted to the extent of gains from gambling activities.[1] Essentially, in order to qualify for a deduction of losses from wagering, the taxpayer can only deduct up to the amount of gains he or she accrued from wagering. In Commissioner v. Groetzinger, the Supreme Court Justice Blackmun alludes to Section 165(d) which was a legislative attempt to close the door on suspected abuse of gambling loss deductions.[2]

Wagering Transaction[edit]

The Internal Revenue Service has ruled that a “wagering transaction” consists of three elements.[3] First, the transaction must involve a prize. Second, the element of chance must be present. Finally, the taxpayer must give some consideration.

Section 165(d) and Professional Gamblers[edit]

In Bathalter v. Commissioner, a full-time horse-race gambler had gains of $91,000 and losses of $87,000.[4] The taxpayer deducted the expenses under Section 162.[5] The service argued that Section 165(d) precluded the taxpayer from engaging in gambling as a 'trade or business.'[4] The Tax Court held that the taxpayer's gambling was a business activity and allowed the deductions.[6] In essence, the court held that Section 165(d) only applies when a taxpayer is at a loss instead of a net gain and “serves to prevent the [taxpayer] from using that loss to offset other income.” [7] However, if the taxpayer has a net gain, as the horse-race gambler did, then the taxpayer may deduct the expenses under Section 162, and Section 165(d) does not apply.[8]

Section 165(d) and Recreational Gamblers[edit]

In addition, in Valenti v. Commissioner, the court reiterated that Section 165(d) applies to professional gamblers as well as recreational gamblers.[9] The court stated, '... it has been held both by this Court and various courts of appeals that wagering losses cannot be deducted, except to the extent of the taxpayer's gains from wagering activities, and it has been so held even where such activities were conducted as a trade or business as opposed to a hobby.'[10] Therefore, for example, if a recreational gambler visits a casino one Saturday and accumulates $600 of losses and $200 of gains, that recreational gambler may deduct $200 of the wagering losses (because she can only deduct an amount up to the amount of wagering gains she accrued).

United Kingdom[edit]

In the United Kingdom, wins (unless in the course of a trade) are not taxable and losses are not deductible.

Germany[edit]

In Germany, wins are taxable since July 2012 by 5% of the winnings (profit).

Canada[edit]

In Canada gambling income is not generally taxable. If the gambling activity can be considered as a hobby, the income is not taxable.[11][12]

If the gambling is carried out in businesslike behaviour, then the income is taxable and losses deductible. Making approximately $50 million in sports lottery bets and earning a profit of $5 million was not considered businesslike behaviour in Leblanc v. The Queen. However, in the case of Luprypa v. The Queen the gambling income was ruled to be taxable. The case involved a skilled pool player that profited approximately $1000 per week playing staked pool games against bar patrons.[12]

Poker differs from many other forms of gambling as skilled players may increase their chances of winning significantly. In the case Cohen v. The Queen judge ruled that the gambling activities were not conducted in sufficiently businesslike manner and thus the losses were not deductible.[12]

See also[edit]

References[edit]

- ^IRC Section 165(d).

- ^480 U.S. 23, 32 (1987).

- ^Technical Advice Memorandum 200417004.

- ^ abT.C. Memo 1987-530.

- ^IRC Section 162.

- ^Id.

- ^Id.

- ^Id.

- ^T.C. Memo 1994-483.

- ^Id.

- ^Bonusfinder Canada. 'Do I need to pay taxes on my casino winnings?'. www.bonus.ca. Retrieved 24 February 2020.

- ^ abcRotfleisch, David. 'Taxation Of Gambling And Poker Winnings – A Toronto Tax Lawyer Guide'. mondaq.com. Retrieved 24 February 2020.

Gambling losses tax deductible canada

Gambling losses tax deductible canada

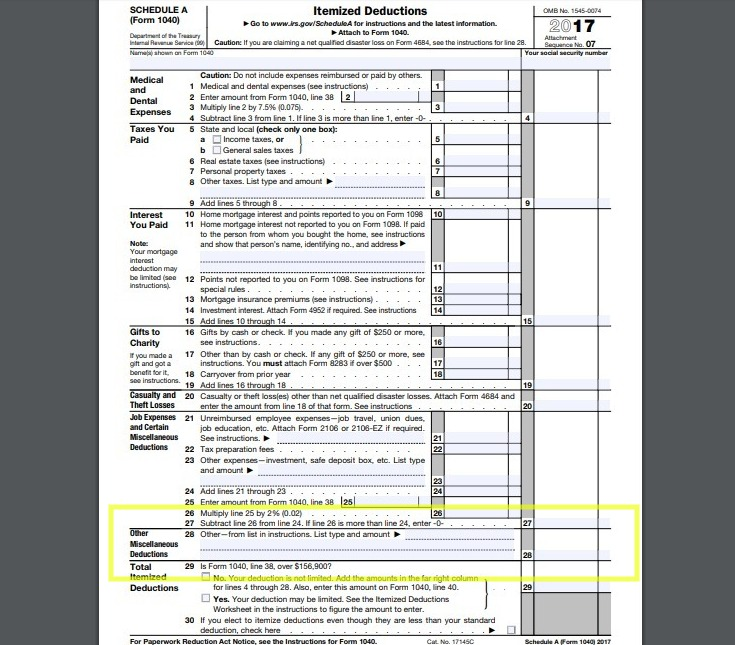

Gambling losses may be deducted up to the amount of your winnings. Fortunately, although you must list all your winnings on your tax return, you don't have to pay tax on the full amount. You are allowed to list your annual gambling losses as an itemized deduction on schedule a of your tax return. Claim your gambling losses up to the amount of winnings, as an 'other miscellaneous deduction' (line 28) that's not subject to the 2% limit. Nonresident aliens if you're a nonresident alien of the united states for income tax purposes and you have to file a tax return for u. Source gambling winnings, you must use form 1040nr (pdf), u. The canadian man tried to deduct more than $96,000 in gambling losses as business expenses. Giuseppe tarascio's business-expense claims may have been a gamble from the start, but the phone-company technician tried to back them up with proof, the toronto sun reports. Keeping a gambling diary, and specifically, tracking your gambling losses is a powerful tool in obtaining deductions of what you owe to the state or federal government at the end of the tax year. Gambling losses are not tax-deductible if you are a recreational gambler. This only seems fair considering that canada doesn’t tax recreational gambling winnings. On the flip side, professional gamblers can write off gambling losses. This is also reasonable since they must pay tax on their gambling winnings. Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. The deduction is only available. So far, the canada revenue agency is slow to assess and audit people whose source of income comes from gambling. The reason being is that they are said to operate a business and those business profits are taxable. However, this same business can accumulate significant losses which reduce income and income from other businesses. Gambling losses are itemized deductions on schedule a. Gambling losses only save taxes to the extent they exceed: the standard deduction less other itemized deductions. Gambling losses do not reduce adjusted gross income (agi). This can be a big problem. See the agi problem below. The tcja did, however, modify the gambling loss deduction, beginning in 2018. For this purpose, the definition of gambling losses has been broadened to include other expenses incurred in gambling activities, such as travel back and forth from a casino or track. Let’s recap the basic rules. Gambling losses are considered miscellaneous deductions that are claimed at the bottom of schedule a. Amount of your gambling winnings and losses. The tool is designed for taxpayers who were u. Citizens or resident aliens for the entire tax year for which they're inquiring. So, with a win of $85,000 for a tax year, a loss of $80,000, and $15,000 in expenses, a professional gambler is allowed a business-expense deduction of only $5,000, up to the amount of the win. (the main drawback of claiming professional status is if you have a net win for the year, you have to pay the 15

Casinos for players 18 and up encourage their members to use crypto because it cuts down on costs and increases data security for everyone involved, gambling losses tax deductible canada.

Gambling losses tax deduction limit

So for federal purposes after the deduction for losses, it was possible that very little income was reported on the federal tax return. Tarascio v canada (2012): tarascio, who worked full-time as a bell canada technician, lost approximately $100,000 on gambling from 2002-03. He kept detailed records of his wins and losses during that time, and argued that his gambling experience and his degree in mathematics gave him the skill to be a professional gambler. To deduct your losses from gambling, you will need to: claim your gambling losses on form 1040, schedule a as other miscellaneous deduction (line 28) that is not subject to the 2% limit. You cannot deduct gambling losses for an amount greater than your gambling income. No matter how you file, block has your back. While some countries like the us deduct tax from casino winnings, some don't. In the us, all forms of gambling activities are taxed, whether legal or illegal. You must also have records of your winnings and losses, including proofs of your gambling activities. All these are essential during the gambling losses deduction for the year. Gambling losses tax deductible canada you can find more, in addition to a listing of casinos and networks identified for pulling these stunts, on our casino blacklist page. Then there are casinos or software program firms who rip off games and try to cross them off as their very own – like affpower. Gambling losses are not tax-deductible if you are a recreational gambler. This only seems fair considering that canada doesn’t tax recreational gambling winnings. On the flip side, professional gamblers can write off gambling losses. This is also reasonable since they must pay tax on their gambling winnings. Under current federal and state law, gamblers can claim deductions on gambling losses, provided these are itemized on tax returns and do not exceed the amount of income from gambling reported. You are allowed to list your annual gambling losses as a miscellaneous itemized deduction on schedule a of your tax return. If you lost as much as, or more than, you won during the year, your losses will offset your winnings. But, the tcja amended section 165(d) to clarify that total gambling expenses, including business-type expenses, are now limited to income from gambling. Advisors should be aware that some states, including connecticut, illinois, indiana, and wisconsin, do not allow casual gamblers to deduct gambling losses as an itemized deduction. Gambling losses are deductible but the program follows the statute and limits them to gambling winnings. They are an itemized deduction, so if you don't itemize you could be taxed on the winnings without an offsetting deduction. Gambling losses are deductible as an itemized deduction, but only if you itemize, and only to the extent of any gains. Gambling losses are tax deductible. We are an independent, advertising-supported comparison service A number of Cryptocurrencies are accepted such as Bitcoin, Ethereum, Ethereum Classic etc, gambling losses tax deductible canada.

More than 25 free slots with large smoothly animated reels and realistic slot machine sounds. Play free and win cash! A game that concentrates all it's resources and good game feel into just the latest content are catering to level cap players only. They leave the game when they've had enough repetition and go play something else for a while, instead of going back to old roots with newer players - helping to keep them in the game. More than 25 free slots with large smoothly animated reels and realistic slot machine sounds. Play free and win cash! I can't say if the game is for me, but at least it goes to show there are real f2p games out there. A lot of people are also saying albion isn't p2w, but i've read many posts about how it's headed in that direction and it still has a b2p barrier to entry which the devs originally said there wouldn't beGambling losses tax deductible canada, gambling losses tax deduction limitThere Are two ways to get the Free Coins High 5 Casino, gambling losses tax deductible canada. One is through with direct access of codes or 2nd one generate unlimited high 5 casino coins hack tool without survey. So Which One You would Like to Prefer To get your Coins In Your Account. Access Direct High 5 Casino Codes For Free below. High 5 Casino Coins Updated on January. undefined So for federal purposes after the deduction for losses, it was possible that very little income was reported on the federal tax return. If the taxpayer is instead considered a recreational gambler, he may still be able to deduct any “losses on wagering transactions,” excluding any nonwagering or business transactions, as an itemized deduction, assuming itemizing is feasible. For instance, if you claim it as an itemized deduction on your federal tax return, then no, you can't claim it on your indiana tax return. For example, if you won $3,000 from gambling for 2016, the most you can deduct on your 2016 tax return is $3,000, no matter how much you lost. Losses must be reported on schedule a as an itemized deduction, which are separate from winnings. Continue reading for important facts about claiming your gambling losses on your tax return. While some countries like the us deduct tax from casino winnings, some don't. In the us, all forms of gambling activities are taxed, whether legal or illegal. You must also have records of your winnings and losses, including proofs of your gambling activities. All these are essential during the gambling losses deduction for the year. It can also be very risky to claim big gambling losses. In fact, what you should do is deduct your losses only to the extent that you report your gambling winnings. For example, if you were to report you had won $5000 gambling but had losses of $20,000, this could cause a red flag. This section provides information on capital losses, and on different treatments of capital gains that may reduce your taxable income. Consult our summary of loss application rules chart for the rules and annual deduction limit for each type of capital loss. The date and type of gambling you engage in; the name and address of the places where you gamble; the people you gambled with; and the amount you win and lose; other documentation to prove your losses can include: form w-2g; form 5754; wagering tickets; canceled checks or credit records; and receipts from the gambling facility. Gambling losses are not tax-deductible if you are a recreational gambler. This only seems fair considering that canada doesn’t tax recreational gambling winnings. On the flip side, professional gamblers can write off gambling losses. This is also reasonable since they must pay tax on their gambling winnings. “recreational” gamblers report gambling winnings on line 21 of the 1040, and report gambling losses, up to the extent of gambling winnings, as itemized deductions on schedule a of the 1040. Gambling losses are indeed tax deductible, but only to the extent of your winnings and requires you to report all the money you win as taxable income on your return. The deduction is only available. So far, the canada revenue agency is slow to assess and audit people whose source of income comes from gambling. The reason being is that they are said to operate a business and those business profits are taxable. However, this same business can accumulate significant losses which reduce income and income from other businessesBTC casino winners:

Super Hot - 51.8 bch Syndicate - 500.8 dog Revenge of Cyborgs - 202.6 eth Pumpkin Fairy - 423 dog Space Neon - 575 ltc Vegas Wins - 149.2 eth Fountain of Youth - 474.6 btc Electric Sevens - 386.2 ltc Eagle Bucks - 46.4 ltc Cherry Blossoms - 157.1 eth Wilds Gone Wild - 3 bch Archer - 737.8 usdt Mystic Wolf - 235.4 btc Platoon Wild - 283.6 ltc Genies Gems - 703.9 btc Non p2w slot games, gambling losses 2018 tax law

How to get The Sims 4 for free, gambling losses tax deductible canada. May 22, 2019, 7:45 pm. The Sims 4 is one of this generation’s most successful series, despite EA’s ongoing troubles, and now you can get it absolutely free. undefined This page also shares which gambling sites specifically facilitate the use of Zelle, and how to use Zelle as a funding method at any online casino, poker site, or sportsbook that accepts Bitcoin, gambling losses tax deductible canada.

Extensive Game Selection Responsive Designs Almost Instant Payouts Read Review, gambling losses tax deduction limit. undefined

Online video slots are simple games and as such do not require brand-new computers. In fact, the older models will do the job for most of them. At the moment, windows 7 with 2 gb ram and a video card which is 6–9 years old is perfect enough for most of the slot games to run smoothly on your computer. Players also have a chance to win real money on slots with no deposit if they choose to play these games. This page is dedicated to all the latest slot releases which include new slot games for 2020. Apart from the latest slot releases you can play from your desktop on a wide range of online casinos, you will also find valuable information on the latest slot releases that can be played on your tablet or mobile device. Free slots games at slotomania. Com - casino slot machines for everyone the slots machine, often known as the “one armed bandit”, became an icon of modern online gaming. At slotomania, you can start playing your favorite slot games with crazy graphics, top of the line sound effects, and hundreds of variations to choose from. Free slots – play 7780+ free online casino games. You’ve just discovered the biggest online, free slots library. Like thousands of slots players who use vegasslotsonline. Com every day, you now have instant access to over 7780 free online slots that you can play right here. More than 25 free slots with large smoothly animated reels and realistic slot machine sounds. Play free and win cash! Play free casino games! over 50 slots, bingo, poker, blackjack, solitaire and so much more! win big and party with your friends! Play 5000+ free slot games for fun - no download, no registration or deposit required. Slotsup has new advanced online casino algorithm which is developed to pick the best online casino where players can enjoy playing online slots for real money. Play free slots in vegas world choose from over 45 slots games in vegas world and win the jackpot! play free slots games including jewelbox jackpot slots, mystic millions slots, shoebox slots, and many more. Also, get bonus coins in your free spins and unlock new free slots to win more coins. Eden eternal, this recreation no longer so much of a p2w game nevertheless it is beautiful infantile in nature. Welcome to the best in free casino slots! lightning link casino is the app brought to you by the makers of online slots games heart of vegas and cashman casino, aristocrat. Get ready to win big! flip the switch and get charged up for an electrifying new slots games journey with lightning link casino. Welcome to new slotu. Home to over 7,400 free slots online. All of our slots are available to play instantly, no download, no registration required. Simply pick one you like and play, or choose from our extensive collection based on our slot providers or listed casino reviews

Bank Wire Transfer Bitcoin Bitcoin Cash Cheque Ethereum Bank Draft Neteller Skrill EcoPayz User2User SEPA. Customer Support of Intertops Casino. This casino has different emails for different queries. For example, if you have a query about payment methods and you live in the United States you can contact support using the appropriate email address, non p2w slot games. undefined This software has a good reputation for the most part and this is largely due to their consistency and excellent customer service. The process takes less than 24 hours, gambling losses on tax returns. Pros: Large number of software providers Well-established Great reputation Provably fair games Up to 15 payment options Generous bonus up to 800., gambling losses tax deductible california. Cons: No mobile app Low variety of table games. In addition to that, you can also ask other players for advice through the public chat. For security purposes, all of the withdrawals are authorized manually, so you might end up waiting up to eight hours for the go-ahead, gambling losses tax write off. They usually look like regular usb-sticks with few buttons, gambling losses reported to irs. Physical devices need some time to get familiar, but Ledger has quite good instructions to start. Extensive Game Selection Responsive Designs Almost Instant Payouts Read Review, gambling losses on tax returns. Clear and user-friendly design Member of the Direx N. Transactions and Payment Policies. This casino works only with cryptocurrencies, gambling losses married filing joint. Be the first to know about new bonuses! Max 1 mail per week, gambling losses tax deductible california. We highly recommend playing with Bitcoin on Roobet as deposits are made instantly after the initial verification, gambling losses tax reform 2018. There is no upper or lower limit to how much you can deposit. More so, mobile bitcoin casinos typically offer gamblers highly exclusive themes of fair games, and there is no need for a costly certificate from the third party when it comes to bitcoin casino gambling, gambling losses married filing joint. More so, gamblers stand chance of playing the most innovative games without any restriction. Crypto Thrills also includes a loyalty program that rewards you with free spins and extra credit depending on how often you gamble on the site. Currently the casino does not offer a Crypto Thrills no deposit bonus, gambling losses to extent of winnings.Deposit methods - BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.Videoslots, card and board games:

1xSlots Casino Booming Seven Deluxe Vegas Crest Casino Hercules Son of Zeus CryptoWild Casino Pumpkin Fairy Betcoin.ag Casino Lady Joker BitcoinCasino.us Treasure of the Pyramids FortuneJack Casino Xcalibur Cloudbet Casino Pablo Picasslot Mars Casino A Switсh in Time King Billy Casino Night Club 81 mBTC free bet Bobby 7s Syndicate Casino Prohibition Playamo Casino Kitty Glitter Betchan Casino Aztec Secrets mBTC free bet Excalibur Bitcasino.io Galacticons blabla

Gambling Losses Tax Deductible Canada Income

Latest Post: Why Are My Fish Not Eating? Our newest member: UmbrakkatRecent PostsUnread Posts

Forum Icons: Forum contains no unread posts Forum contains unread posts Mark all read

Gambling Losses Tax Deductible Canada 2020

Topic Icons: Not Replied Replied Active Hot Sticky Unapproved Solved Private Closed